Supporting Affordable Homeownership for Filipino Workers

The Pag-IBIG Fund has officially announced it will maintain its low interest rates on housing loans through the end of 2025. This move reinforces the agency’s commitment to making homeownership more affordable and accessible, especially for Filipino workers from minimum-wage and low-income sectors.

Secretary Jose Ramon P. Aliling, Chairperson of the Pag-IBIG Fund Board of Trustees and Secretary of the Department of Human Settlements and Urban Development (DHSUD), highlighted the importance of this initiative. He said, “By keeping rates low, we make monthly amortizations more affordable, enabling more of our members—especially those who are minimum-wage earners and from low-income sectors—to finally move into homes they can truly afford.” This initiative aligns with the government’s vision to build a “Bagong Pilipinas” where every Filipino has access to safe, affordable, and resilient communities.

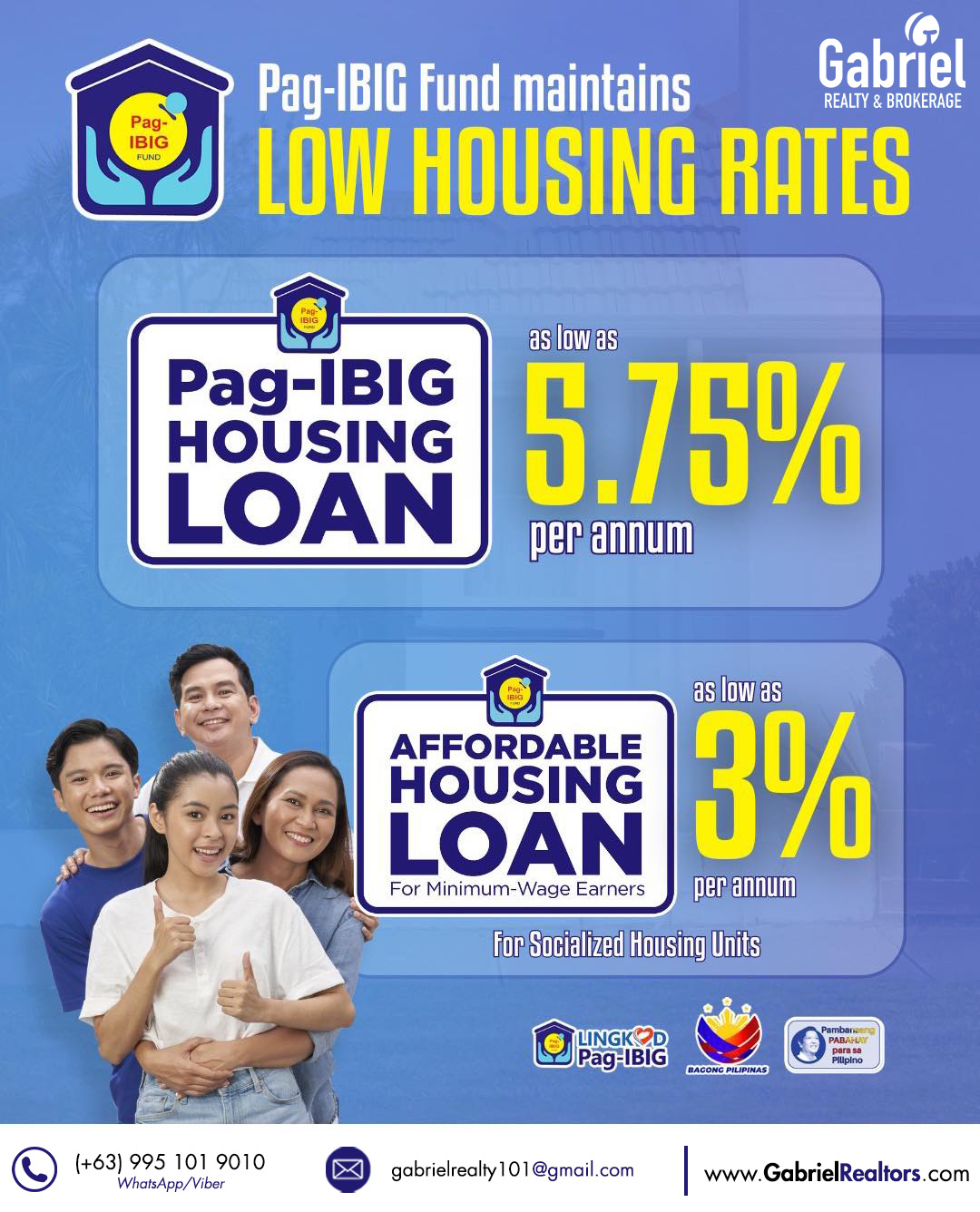

Attractive Loan Terms and Special Programs

Pag-IBIG Fund offers competitive housing loan interest rates designed to ease financial burdens:

- One-year repricing period: 5.75% per annum

- Three-year repricing period: 6.25% per annum

Additionally, qualified low-income members may avail themselves of even lower rates under the Affordable Housing Program, with socialized housing units available at just 3% per annum. Loan terms can extend up to 30 years, allowing monthly payments to remain manageable for many Filipinos.

Financial Stability Ensures Continued Support

Pag-IBIG Fund Chief Executive Officer Marilene C. Acosta attributes the sustained low rates to the agency’s strong financial health. She said, “Pag-IBIG Fund’s prudent fiscal management, strong collections, and high-performing loan portfolio continue to keep us financially sound, enabling us to finance our members’ housing needs without external borrowing.”

This financial robustness allows the Pag-IBIG Fund to maintain affordable loan rates and expand housing financing access, particularly to underserved sectors. The agency continues to support the Marcos administration’s housing thrust by helping more Filipinos secure homes they can call their own.

Strong Performance Highlights

The announcement comes on the heels of Pag-IBIG Fund’s impressive performance in early 2025:

- Released ₱30.22 billion in home loans in the first quarter alone

- Benefited over 20,000 members nationwide

- Total assets exceeded ₱1.1 trillion as of March 31, 2025

These figures reflect the agency’s capability to provide sustained long-term support for affordable housing finance.